ApTEL sets aside CERC order on REC Price revision | RECs trading likely to start soon

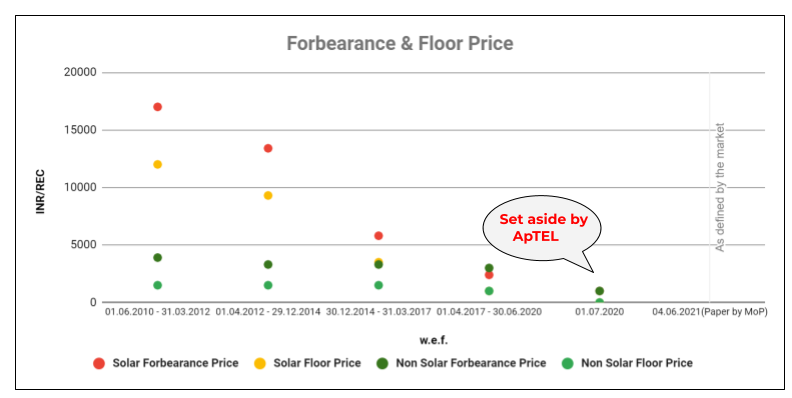

In an important advancement, ApTEL has delivered its judgment on the matter of REC today. According to the order of ApTEL dated 11.09.2021, they set aside the order dated 17.06.2020 passed in Petition no. 05/SM/2020, by the Central Electricity Regulatory Commission(CERC), revising the floor and forbearance price of solar and non-solar RECs at Rs. 0/MWh and Rs. 1000/MWh respectively.

In practical terms, it means:

- The price revision made by CERC to a floor price of Rs 0/ MWh and forbearance price of Rs 1000/ MWh is no longer applicable

- Trading is likely to resume in the near future with the older prices being applicable (for Non-solar a floor price of Rs 1000/MWh and forbearance price of Rs 3000/ MWh, and for Solar a floor price of Rs 1000/MWh and forbearance price of Rs 2400/ MWh)

The primary reasons for ApTel setting aside CERCs order are:

- Inadequate consultation with FoR, POSOCO and other stakeholders. The order states:

“115. The process of consultation mandated by the Regulations is not an empty formality. The Commission has failed to show, either in the impugned order, or by proceedings drawn anterior thereto, conscientious consideration of, or sufficient reasons cited for, either accepting or rejecting such comments as noted above. The requirement in Regulations of “consultation” with the two specified agencies – POCOSO and FOR – is, as observed in Cellular Operators Association of India (supra), a means of holding the statutory authority (CERC) “accountable for administering the laws in a responsible manner, free from arbitrary conduct”. The ultimate decision of the authority after “consultation” mandated by law “must articulate a satisfactory explanation for its action, including a rational connection between the facts it found and the choices it made”. The impugned order fails to pass this muster as well. We find the observations of CERC vis-à-vis the above-extracted comments of DERC, KERC, POCOSO rather vague.” (Emphasis supplied)

- Incorrect approach in considering competitive bid tariffs for determining RECs prices. The order states:

“78. We agree with the appellants that CERC has fallen into grave error by relying upon the competitive bid tariffs adopted by some ERCs because of the declining trend of bid discovered tariff on assumption that such phenomena could only be due to a reduction in cost of generation and for the reason that various Commissions have stopped passing generic tariff orders.” (Emphasis supplied)

- The validity of existing RECs to be extended for the remainder of their validity as it stood on the date of the original order (17/6/2020).

- Inefficient implementation of RPO. The order states:

“98. There seems merit in the plea that due to non-compliance of the RPO targets by the Obligated Entities, the recovery of green components (RECs) by the RE generators have been seen generally to lag behind, adding to the reasons for huge unsold inventory.”

Likely impact of the order:

- RECs trading is likely to commence soon at the previous floor and forbearance prices. Trading may even commence as early as on November 24 (but we will have to wait and watch).

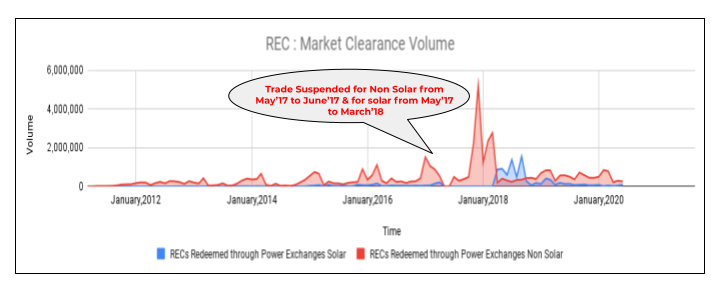

- Since trading has been suspended since June 2020, there is likely to be significant demand when trading resumes.

- We may see changes in the REC mechanism in the near future based on proposal by Ministry of Power (see summary here – https://reconnectenergy.com/power-minister-approves-revamped-rec-mechanism)

- The finding by Aptel that it is incorrect to use competitive bid based tariff’s for price determination of RECs may have an impact on the case currently being considered by the Supreme Court (https://reconnectenergy.com/supreme-court-allows-conditional-trading-for-non-solar-recs/ )

ApTEL has directed CERC to issue formal orders to give effect to its order within two weeks.

Quick snapshot of the past trends of REC related phenomenon and our speculation once the trade resumes, are as follows:

- Floor and Forbearance Price –

Past trend: Floor & Forbearance Price

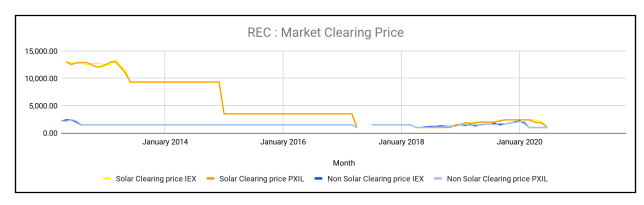

2. Market Clearing Price & Market Clearing Volume

Owing to the stay order for REC trading for more than a year now, the supply of RECs have piled up in the last couple of months. On the other hand, RPO clients could not fulfill their obligation for over a year due to the unavailability of REC.

Even though the impugned order on price revision is being set aside by ApTEL, the order prevailing prior to 17 July 2020 order would be applicable so long as a fresh order on the subject is not issued.

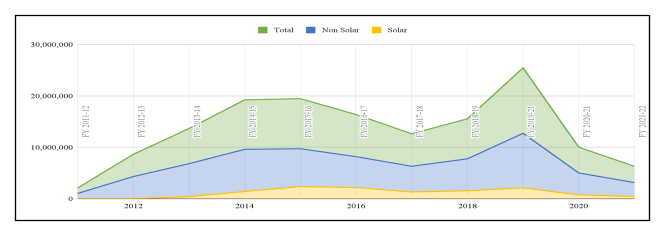

3. REC Issuance trend

In recent years, the stay on REC trading because of last CERC order on floor and forbearance price has resulted in steep decline in REC issuance. On the other hand, the offtake of RECs had also been stopped since July 2020. Currently, as on 09.11.2021, total inventory of Solar RECs are 11,63,599 and Non Solar RECs are 76,35,934 as per the REC Registry report.

Disclaimer: This note is being provided for market understanding purposes only and is based on the publicly available information. REConnect Energy does not warrant the accuracy or completeness of information available and therefore will not be liable for any loss incurred from the use of this report. Any commercial decision either on the future price or market volume of RECs by the reader shall at the sole discretion and risk of the reader.