Carbon Market Draft Rules: India’s Compliance Era Begins

India has taken a landmark step towards formalising its carbon market framework by notifying the Draft Greenhouse Gas Emission Intensity (GEI) Rules, 2024. Issued by the Ministry of Environment, Forest and Climate Change (MoEFCC), these rules have put forth legally binding emission reduction targets for over 450 industrial entities beginning FY2025-26. This notification will thus put into effect a core feature of India’s Carbon Credit and Trading Scheme (CCTS) and operationalise a new era of regulatory accountability in climate mitigation.

Policy at a Glance

So what’s new? For the first time, India’s carbon intensity targets will be legally binding for designated industrial sectors.

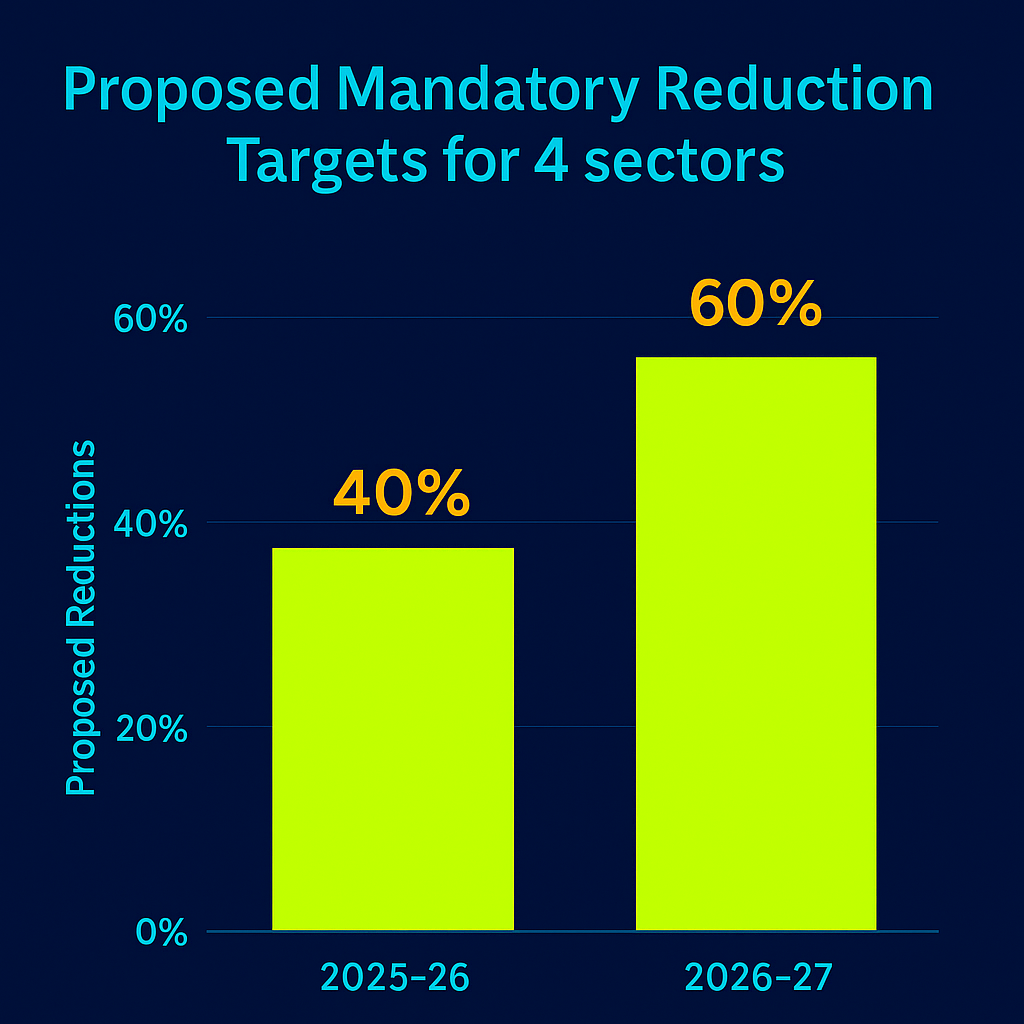

Four energy intensive and hard to abate sectors like aluminium, steel, cement, petrochemicals, textiles, and chlor-alkali are covered. Non-compliance will attract a financial penalty double the prevailing market price of carbon credits. Firms can meet targets through in-house reductions or procurement of carbon credits under the Bureau of Energy Efficiency (BEE). Figure 1 below adds some perspective:

“India’s draft rules thus mark a major milestone from voluntary to enforceable carbon action by embedding carbon intensity limits into law, with real financial implications and market-based compliance pathways.”

Strategic Policy Implications

1. India’s Compliance Carbon Market Enters Operational Phase

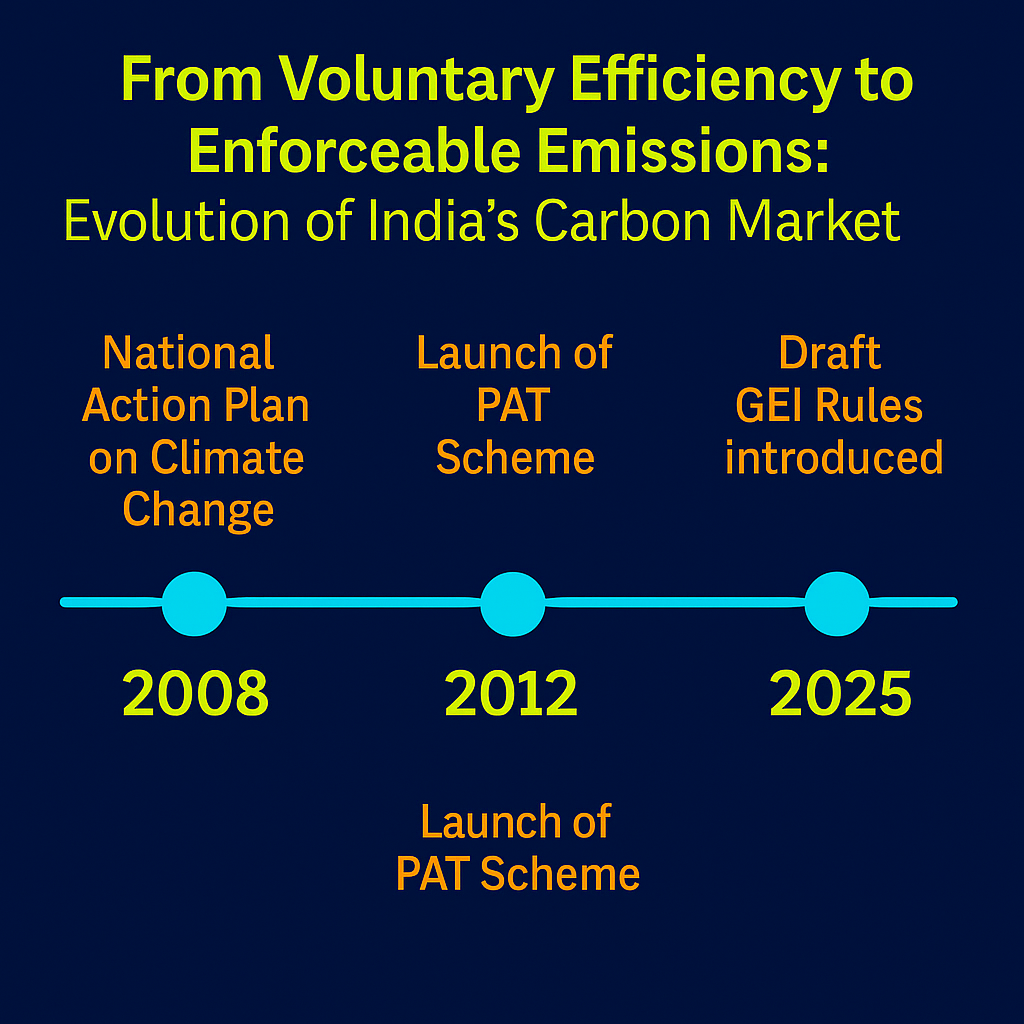

There is an evident evolution in India’s pilot of Perform, Achieve, and Trade (PAT) model to a full-fledged compliance regime. While the PAT scheme focused on improving energy efficiency, the new GEI rules place direct quantifiable limits on emissions intensity which is in sync with international carbon markets. This regulation has effectively made India one of the few developing economies with a commitment towards enforceable carbon limits, positioning it strategically for Carbon Border Adjustment Mechanisms (CBAM) from the EU or others. Figure 2 below gives you a policy timeline:

2. Institutional Coordination Will Be Key

The new rules will be jointly overseen by the following agencies:

Bureau of Energy Efficiency (BEE): Baseline setting, credit validation, and compliance checks

Central Pollution Control Board (CPCB): Enforcement of financial penalties

MoEFCC: Periodic updates to sectoral targets.

This multi-agency approach will have to address critical data interoperability, registry integration and credit fungibility between energy and carbon markets.

3. Credit Pricing and Volatility Risks

Unlike earlier voluntary markets, the GEI rules will introduce a penalty which has been benchmarked to market price thus creating dual uncertainty such as:

- Prices of carbon credits could spike due to scarcity or speculative trading.

- Non-compliance penalties could rise significantly, especially if credit liquidity is not guaranteed.

The policy opens critical questions about the role of market makers, trading oversight and whether credit banking or price ceilings will be allowed.

Learning from the ESCERTs and RECs market suggests that the validity of the instrument plays a significant role in ensuring market liquidity. For example, in the REC market, the poor enforcement of RPO and thus inadequate demand (liquidity) pushed the policy markers to allow perpetual validity of RECs. Now, the perpetual validity of RECs is working against the buyers of RECs who wish to comply but the supply does not come to the market at the same speed.

4. Overlaps with Power Sector Market Reforms

Clickpower.in analysis suggests a growing synergies between:

- The carbon market via GHG intensity caps

- The electricity market via proposed virtual Power Purchase Agreements (VPPAs), and Green Energy Open Access and electricity derivatives

Example: Captive power being utilised in steel or cement must now optimise power procurement (via exchanges or PPAs along with risk management through electricity derivatives) not just on price but on emission performance, creating a carbon-linked dispatch intensive structure. This is a regulatory confluence that C&I buyers must immediately map and exploit to minimise the cost of various environmental compliances.

What Industrial Units Must Do Next

Industrial units must begin by auditing their FY2023–24 emissions data and comparing it against the proposed intensity targets to project compliance scenarios for 2025 and beyond. Putting in place an integrated energy and carbon management approach is critical to develop cost projections, strategize credit procurement and integrate insights into executive reviews. With draft rules being opened for public feedback, stakeholders should engage proactively; especially on issues like target design, penalty structure and logistics for implementation. Comments are due by mid-August via the MoEFCC portal.

Policy Perspective

This draft rule is not just an environmental regulation but rather an infrastructure layer of a climate market economy. India’s move from a voluntary incentive-based regime to a system of quantifiable obligations and enforceable carbon pricing is expected to shift climate action – from corporate CSR agendas to balance-sheet reality.

This policy will have a ripple effect across four key domains:

1. Industrial Decarbonisation Investment

Carbon pricing is now real. Industrial emitters must now treat it as a financial certainty, not a future risk. Every CAPEX decision, from fuel switching to CCS will have to weigh carbon liability.

2. Power Procurement Strategy

C&I buyers can no longer optimize only for tariffs. With virtual PPAs, Green Open Access Rules and electricity derivatives at play, sourcing must now factor in emissions performance. The days of depending on captive coal might be approaching their end.

3. Corporate ESG and Financial Disclosure

Carbon intensity is now a regulated variable. Mandatory disclosures under Business Responsibility and Sustainability Reporting (BRSR), Task Force on Climate-Related Financial Disclosures (TCFD) and SEBI’s new ESG rating mandates are to be expected. Non-compliance will affect market perception and access to green finance.

4. Trade Exposure and Export Risk

India’s domestic carbon enforcement offers protection from EU’s Carbon Border Adjustment Mechanisms (CBAMs). Transparent Monitoring, Reporting, Verification (MRV) and strong registry integration will determine if India can use its carbon market as a trade enabler, not barrier.

For us, this marks as a pivotal shift in India’s climate governance and we’ll stay on the pulse to support stakeholders with:

- Sector-specific diagnostics on carbon and power market exposure

- Strategic insights on regulatory interactions

- Advisory on compliance readiness, MRV design, and credit procurement.

India is not just capping emissions but institutionalising carbon as an economic variable. Its imperative to continue monitoring this space as a domain specialist by offering diagnostics, market intelligence and sector-specific advisory.