The Future Price of Power: Why Electricity Derivatives Matter for India’s Market Evolution

In a world where electrons flow in real time but markets often lag behind, electricity derivatives represent the financial sophistication India’s power sector needs but policymakers have been cautiously avoiding. For a country hurtling toward a high-renewable, decentralised, and demand-responsive grid, these instruments are not just financial novelties. They are strategic enablers of stability, efficiency, and resilience.

India’s electricity sector today sits at a complex crossroads. Uncertainty is on the rise right from coal logistics to renewable variability, from peak pricing spikes to geopolitical shocks. Concurrently, market reforms such as real-time markets, green term-ahead contracts, and the gradual shift toward market-based economic dispatch are demanding a new toolkit. In this scenario with critical uncertainties, electricity derivatives emerge not as speculative adventures but as essential hedging instruments that civilise volatility and enable strategic planning.

What Exactly Are Electricity Derivatives?

In layman terms, electricity derivatives are contracts – allowing market participants to fix prices for a future date. These are cash-settled instruments where money changes hands, but electrons do not. Futures contracts permit parties to agree to a given price for a fixed quantity of electricity to be settled at a later date and is the most prominent format. Such contracts are already traded on Indian power exchanges under dual regulatory oversight by SEBI and CERC.

But these contracts go far deeper than hedging prices. Derivatives allow distribution companies to bring predictability to their procurement costs. They enable open access consumers to manage exposure to volatile short-term markets. They give generators an insurance-like instrument to secure cash flows against falling merchant tariffs. Lastly, they offer traders and financial institutions a route to price discovery, arbitrage, and liquidity creation.

In a system where electricity prices fluctuate wildly by the hour, week, or season, derivatives are the difference between firefighting and foresight.

Why Now?

The timing of this shift is not coincidental. In the last five years, India has seen a confluence of structural and institutional changes in India’s electricity market.

First, increased share of renewables has intensified variability, pushing up short-term price volatility. Second, DISCOMS are under increasing pressure to reduce their exposure to rigid long-term PPAs and transition to more dynamic portfolios. Third, the introduction of real-time markets and green power exchanges has enabled a good testbed for financial innovation. Lastly, the joint regulatory framework from SEBI and CERC has resolved a long-standing jurisdictional impasse, paving the way for legally sound derivative instruments in electricity.

This is not a replication job from global markets. India’s approach must adapt to its unique market structures, risk appetites, and institutional capacities. But there is no denying that electricity derivatives are no longer fringe ideas. They are front and centre in the conversation on power sector reform.

Risk Is Not the Enemy

A persistent misconception is that derivatives are inherently risky, or worse speculative. The reality in fact being that the absence of hedging mechanisms forces stakeholders into risky behaviour i.e. over contracting capacity, excessive reliance on spot markets or avoidance of open access altogether. A DISCOM that manages to lock in prices through futures contracts is in a better position to manage its power purchase than one that reacts to real time shocks. A generator that hedges against price crashes is more bankable, especially for merchant or hybrid renewable projects. For industrial consumers with high energy exposure, derivatives become a gateway to cost stability and strategic procurement.

This is the maturity curve of modern electricity markets. Risk is not the enemy. Poor risk management is.

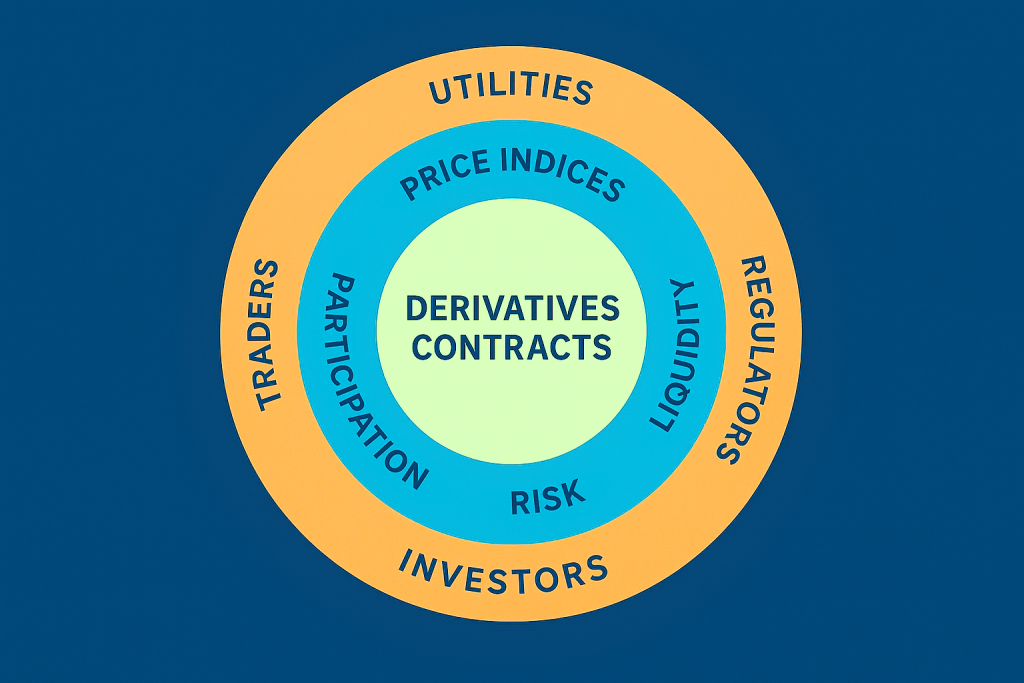

Market Depth and Policy Vision

For derivatives to succeed, India needs more than just contracts on paper. It needs credible price indices, deep liquidity, strong risk management frameworks, and active participation across the board. Policy vision must extend beyond enabling instruments. Embedding them in the operational DNA of utilities, regulators, and investors becomes increasingly important.

The recent regulatory sandbox initiatives, pilot contracts by power exchanges, and capacity-building programs for DISCOMS are moving in the right direction. But scalability is an issue and there is also a need for institutional readiness! How many DISCOMS today have the capacity to manage a derivatives portfolio? How many state regulators are equipped to supervise their use responsibly?

Moreover, as India moves toward integrated market mechanisms like the Market-Based Economic Dispatch (MBED) and plans to rationalise its long-term contracting framework, derivatives will become the quiet workhorse, enabling this transition. They will allow stakeholders to take calculated bets rather than ideological positions.

Beyond the Numbers

The deeper promise of electricity derivatives is that they align the Indian power market with the logic of capital. They bring finance and electricity closer in a structured, risk-managed way. In doing so, they enable smarter investments, better asset utilisation, and a more agile response to shocks.

In a decade where climate volatility, renewable surges, and demand unpredictability will be the new normal, no serious power system can remain unhedged. India’s energy planners and policy makers must embrace this. Not to create a casino of sorts but to build a safety net for market participants who are otherwise flying blind.

A Policy Imperative

It is time we recognise electricity derivatives not as a luxury but as a policy necessity. They have the potential to help stabilize DISCOM finances, derisk renewable investments, and create price signals that reflect not just cost, but value. Their careful expansion is a litmus test for whether India truly believes in its market reform agenda.

For too long, we have focused only on the physical delivery of electricity. But the future of power markets will be just as much about financial delivery but also of certainty, of liquidity, and of informed risk-taking. In that sense, electricity derivatives are not a side story. They are the core of a market-led, resilient energy future.