Underwriting Imbalance costs for Renewables

The Indian power sector is undergoing rapid transformation, and there are several changes in the regulatory commissions which are enforced/put forth to all Wind and Solar generators to ensure the efficient and effective utilization of the country’s renewable resources. One such regulation is the Deviation Settlement Mechanism (DSM). It is a regulatory mechanism that aims to manage the imbalances in the grid and ensure grid stability.

The DSM regulations seek to ensure, through a commercial mechanism, that users of the grid do not deviate from and adhere to their schedule of drawal and injection of electrical energy in the interest of security and stability of the grid. In the context of wind and solar generators, a Qualified Coordinating Agency (QCA) is appointed on behalf of the generators which is responsible for submitting schedules of injection, settling financial dues, etc. Under this mechanism the QCA shall schedule the generator’s power transactions in advance to help maintain grid stability. The regulations and the DSM mechanism are applicable for both intra and inter-state power transactions and aims to ensure smooth and efficient functioning of the power grid.

Intra-State DSM Regulations

The intra-state DSM regulations govern the power transactions within the state. The State Load Dispatch Center (SLDC) is responsible for managing the power supply and demand within the state. The SLDC ensures that the power supply is sufficient to meet the demand and that there are no imbalances in the grid.

The intra-state DSM regulations state that the QCA is responsible to submit the schedules to the respective SLDC. The schedule specifies the power that the generator will supply to the grid at specific intervals (15 mins). The RLDC monitors the power supply and demand and ensures that there are no major fluctuations in the grid frequency.

If any deviation is observed from the schedule and the actual injection of power, the respective wind and solar generators are liable to pay the DSM charges. The penalty is calculated based on the difference obtained between the actual power supply and the scheduled power and the per unit charges are mentioned in the F&S and DSM regulations which are published by the State Electricity Regulatory Commission (SERC).

Inter-State DSM Regulations

The inter-state DSM regulations govern the power transactions between the states. The Regional Load Dispatch Centers (RLDC) are responsible for managing the inter-state power transactions. The RLDCs ensure that the power supply and demand are balanced and that there are no imbalances in the grid.

The inter-state DSM regulations state that the QCA is responsible to submit the schedules to the respective RLDC. The schedule specifies the power that the generator will supply to the grid at specific intervals (15 min). The RLDC monitors the power supply and demand and ensures that there are no major fluctuations in the grid frequency.

If any deviation is observed between the schedule and the actual injection, the respective wind/solar generator is liable to pay the DSM charges. The penalty is calculated based on the difference obtained between the actual power supplied and the scheduled power and the per unit charges are mentioned in the F&S & DSM regulations which are published by the Central Electricity Regulatory Commission (CERC).

The CERC regulations effective from 2023 have brought greater liabilities to wind and solar generators as they have introduced scope for loss of revenue for deviations beyond the specified bands. Here, all WS Sellers deviating by under injection of power shall pay back for the total shortfall in energy at the contract rate. Similarly, for generating stations deviating by over injection of power shall be paid back at the contract rate with respect to the error bands.

Financial Liabilities for Imbalances

The financial penalties for imbalances are levied on the generators to incentivize adherence to schedules and maintain grid stability. The penalties are calculated based on the difference between the scheduled power and the actual power injected. The penalty rates are set by the SERC or CERC, depending on whether it is an intra-state or inter-state transaction. The penalty charges will be higher if the absolute error % is high.

One of the ways to mitigate the imbalance costs is through accurate forecasting. The power demand is influenced by various factors, such as local weather at the wind or solar site, seasonal changes in climate, availability of generation assets, etc. The QCA appointed by the generators predict the power generation accurately to ensure that they can supply the required power and avoid any imbalance in costs. However, forecasting depends on weather conditions/seasonal changes and also the real time data from the site.

As a solution to the uncertainty that arises from highly weather dependent phenomena, we offer underwriting of the risks associated with resulting grid imbalances. Underwriting is a financial mechanism that helps to mitigate the risks associated with the Deviation Settlement Mechanism for renewable energy generators through a fixed monthly rate for QCA services which includes the penalties payable to grid operators. We offer underwriting for DSM to renewable energy (RE) generators to help manage their financial risk related to imbalances in the power grid. These penalties can be unpredictable and vary from day to day, making it difficult for generators to budget and manage their financial liabilities.

- The fixed rate (per month / per MW basis) provides certainty to the generator’s financial liability, as any penalties above the fixed rate for any period of time will attract the same fixed rate to the generator.

- It limits the downside risk, as the generator’s financial liability is not variable, and budgeting for imbalance costs can be done with certainty, doing away with margins of safety usually applied in financial calculations.

- This brings more certainty and stability in the overall financial outflows for the generators, allowing them to plan their finances better and make accurate decisions about future investments.

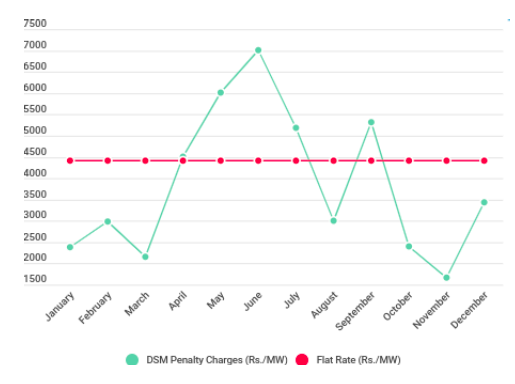

The chart displays the variation in penalties per month for an entire year of a western region wind plant. The DSM penalty charges (Rs./MW) are shown in the green line. As we can see there is a significant variability in the penalties across the year, with some months having much higher penalties than others. In addition to the penalties, the chart also includes the comparative flat rate, shown in red line. It represents variability of charges as well as the downside risk mitigation for some months. We can see that the flat rate is lower than the penalties for most of the year.